The best home budget software for PC is YNAB (You Need A Budget). It offers robust features for effective financial management.

Managing personal finances can be challenging without the right tools. YNAB stands out due to its user-friendly interface and comprehensive budgeting features. It helps users track expenses, set financial goals, and build savings. YNAB’s method encourages proactive budgeting, making it easier to stay on top of your finances.

The software syncs seamlessly with bank accounts and provides insightful reports. Users appreciate its educational resources and community support. YNAB also offers mobile apps for on-the-go budgeting. With its emphasis on financial discipline and clear visualizations, YNAB is a top choice for anyone serious about managing their home budget effectively.

Credit: www.moneypatrol.com

Introduction To Home Budget Software

Managing money can be tricky. Home budget software helps simplify this task. These tools track your income, expenses, and savings. They provide a clear picture of your financial health. Let’s explore why these tools are so important.

The Rise Of Financial Tech

Financial technology, or FinTech, has grown rapidly. More people now use digital tools for their finances. Home budget software is part of this trend. It offers features like expense tracking and financial planning. These tools are easy to use and very effective.

Many software options are available. Some are free; others require a purchase. Each one offers unique features. The rise of FinTech has made managing money much easier.

Why Budgeting Is Essential

Budgeting is crucial for financial health. It helps you manage your money better. You can see where your money goes. You can also plan for future expenses. This helps you avoid debt and save more.

A good budget keeps you on track. It helps you achieve financial goals. Whether saving for a house or paying off debt, budgeting makes it possible. Home budget software makes this process easier and more efficient.

Top Features To Look For

When choosing home budget software, consider these features:

- Expense tracking

- Income management

- Financial planning tools

- Report generation

- Security features

Popular Home Budget Software

| Software | Key Features | Price |

|---|---|---|

| Mint | Expense tracking, Alerts, Reports | Free |

| YNAB (You Need A Budget) | Goal tracking, Real-time sync | Subscription-based |

| Quicken | Comprehensive financial planning | Purchase required |

Credit: www.pcmag.com

Criteria For Selecting Budget Software

Choosing the right budget software for your PC can be challenging. There are many factors to consider to ensure it meets your needs. Here, we break down the key criteria to guide your decision.

Ease Of Use

The software should be user-friendly. It should have a simple and clear interface. Beginners should navigate it without difficulty. Look for software with tutorial guides and customer support. A mobile app for on-the-go budgeting can be a bonus.

Features And Functionality

Effective budget software must offer essential features. Here are some important features to look for:

- Expense Tracking: Track all your expenses easily.

- Income Management: Record and manage your income sources.

- Budget Planning: Plan your budget for different categories.

- Reports and Analytics: Generate reports to analyze spending habits.

- Bill Reminders: Set reminders for upcoming bills.

Advanced features like investment tracking and goal setting can also be valuable.

Security Measures

Security is crucial for budget software. It should protect your financial data. Look for these security features:

- Data Encryption: Ensures your data is safe from hackers.

- Two-Factor Authentication: Adds an extra layer of security.

- Regular Updates: Keeps the software secure and reliable.

Always read reviews and check the software’s reputation for security.

Top Contenders For Home Budget Software

Managing home finances can be a daunting task. The right budget software makes it easier. With many options available, it’s crucial to choose the right one. Here are some top contenders for home budget software to consider.

Popular Choices

These are the most well-known budget software options. They have a large user base and proven track record.

- Quicken: Quicken is a comprehensive financial tool. It allows you to track spending, create budgets, and manage investments.

- YNAB (You Need A Budget): YNAB is great for beginners. It focuses on giving every dollar a job and helps users break the paycheck-to-paycheck cycle.

- Mint: Mint is a free, user-friendly tool. It offers budget tracking, bill reminders, and financial goal setting.

Emerging Players

These budget software options are new but gaining popularity. They offer unique features that set them apart.

- Goodbudget: Goodbudget uses the envelope system. It helps users allocate funds to different spending categories.

- EveryDollar: EveryDollar is simple and intuitive. It allows users to create budgets quickly and track spending easily.

- Personal Capital: Personal Capital combines budgeting and investment tracking. It provides a holistic view of your finances.

Credit: www.bitsdujour.com

Comparative Analysis Of Software Options

Choosing the best home budget software for your PC can be tricky. This analysis will compare the top options. We’ll look at user interface, toolsets, and overall capabilities. This guide aims to help you find the perfect software for your needs.

User Interface Comparison

The user interface is crucial for any software. A clean and intuitive interface makes budgeting easier.

| Software | User Interface |

|---|---|

| Software A | Simple and clean, with easy-to-navigate menus. |

| Software B | Modern design but can be cluttered with too many options. |

| Software C | Classic layout, straightforward but a bit outdated. |

Toolset And Capabilities

Each software comes with its own set of tools. The right toolset can make a big difference.

- Software A: Offers basic budgeting tools, expense tracking, and financial reports.

- Software B: Advanced features like investment tracking and bill reminders.

- Software C: Focuses on simplicity with essential budgeting tools and charts.

Below is a detailed comparison:

| Software | Budgeting Tools | Expense Tracking | Financial Reports | Investment Tracking | Bill Reminders |

|---|---|---|---|---|---|

| Software A | Yes | Yes | Yes | No | No |

| Software B | Yes | Yes | Yes | Yes | Yes |

| Software C | Yes | Yes | Yes | No | No |

Integrating Software With Bank Accounts

Integrating home budget software with bank accounts can simplify your financial management. This feature allows seamless tracking of income, expenses, and balances. With real-time updates, you can make informed decisions quickly.

Linking Financial Accounts

Linking your financial accounts to the software is easy. Most budget software supports multiple banks and credit unions. Follow these steps to link your accounts:

- Open the software and navigate to the accounts section.

- Select your bank from the list of supported institutions.

- Enter your bank login details securely.

- Authorize the connection, and wait for confirmation.

Once linked, your transactions will automatically sync with the software. This eliminates manual data entry, saving time and reducing errors.

Real-time Tracking

Real-time tracking is a game-changer for budgeting. With this feature, you can see every transaction as it happens. This helps you stay on top of your finances without delay.

Here are some benefits of real-time tracking:

- Immediate Updates: Know your spending as it occurs.

- Accurate Balances: Always see your current bank balance.

- Quick Adjustments: Make changes to your budget instantly.

Real-time tracking ensures you are always aware of your financial health. It helps in making quick and informed decisions about your money.

| Software | Bank Integration | Real-Time Tracking |

|---|---|---|

| YNAB | Supports most banks | Yes |

| Mint | Wide range of banks | Yes |

| Quicken | Extensive bank list | Yes |

Choosing the right budget software can transform your financial management. Ensure it supports bank integration and real-time tracking for the best experience.

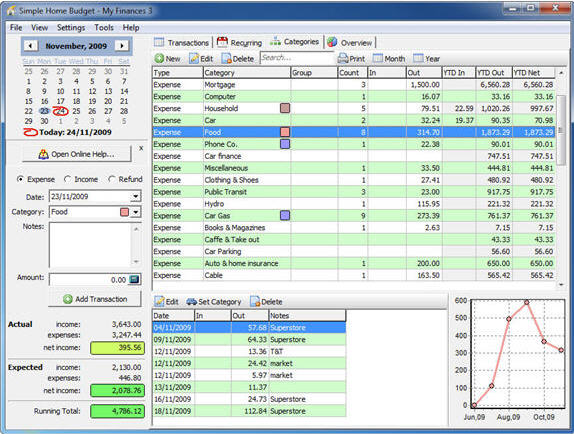

Budget Planning And Reporting Features

Finding the best home budget software for PC can be daunting. You need tools with excellent budget planning and reporting features. These features help manage your money better and keep track of your expenses. Let’s explore key aspects under this section.

Customizable Budget Categories

The best software offers customizable budget categories. You can tailor these categories to fit your needs. For example, you might have categories like groceries, rent, and entertainment.

- Groceries: Track your food spending.

- Rent: Monitor your housing costs.

- Entertainment: Keep an eye on fun expenses.

Customizing these categories helps you see where your money goes. It makes managing your budget easier and more personal.

Visualizing Financial Goals

Visualizing financial goals is crucial for effective budgeting. The best home budget software includes tools for this purpose. You can set goals and track your progress visually.

Here are some common goals:

- Saving for a vacation: Set a target amount and deadline.

- Paying off debt: Track payments and remaining balance.

- Building an emergency fund: Aim for a specific savings amount.

Visual aids like charts and graphs make it easy to see your progress. This helps stay motivated and on track.

| Feature | Benefit |

|---|---|

| Customizable Categories | Tailor to fit your unique needs. |

| Financial Goals Visualization | Track progress with charts and graphs. |

Choosing the right budget software means getting the best tools. These features help you manage your money effectively.

Mobile Accessibility And Cloud Syncing

In today’s fast-paced world, managing your budget on the go is essential. The best home budget software for PC offers mobile accessibility and cloud syncing features. These features ensure you can track your finances anytime, anywhere. Let’s explore how these features enhance your budgeting experience.

Cross-platform Support

Many budget software solutions come with cross-platform support. This means you can access your budget on various devices. Whether you use a PC, smartphone, or tablet, your data stays in sync. This ensures you always have the latest information at your fingertips.

- Windows: Most software supports Windows operating systems.

- iOS and Android: Mobile apps are available for both platforms.

- MacOS: Some software also supports MacOS for Apple users.

Data Accessibility On The Go

With cloud syncing, your budget data is always up-to-date. This feature allows you to access your financial information anywhere. You can update your expenses, monitor your savings, and check your balance on the go. This real-time access helps you make informed financial decisions.

| Feature | Benefit |

|---|---|

| Real-Time Syncing | Ensures data is always current across all devices. |

| Secure Cloud Storage | Keeps your financial data safe and accessible. |

| Multi-Device Access | Allows you to manage your budget from anywhere. |

These features make managing your finances easier and more efficient. By using software with mobile accessibility and cloud syncing, you can stay on top of your budget no matter where you are.

User Reviews And Testimonials

User reviews and testimonials offer real insights into home budget software. They help us understand its strengths and weaknesses.

Success Stories

Many users share their success stories with budget software. These stories highlight how the software helped manage finances.

- John D. saved $500 in three months using the app.

- Sarah L. managed to clear her credit card debt in a year.

- Mike T. improved his credit score by 50 points.

These stories show the real impact of good budget software. They can inspire others to take control of their finances.

Common Critiques

Not all user experiences are positive. Common critiques help improve the software.

| Critique | Explanation |

|---|---|

| Complex Interface | Some users find the interface hard to navigate. |

| Limited Features | Basic versions often lack advanced budgeting tools. |

| Sync Issues | Users report problems syncing with bank accounts. |

Understanding these critiques can guide users to choose the best software. It also helps developers make necessary improvements.

Advanced Features For Savvy Users

Choosing the best home budget software for your PC is essential. Savvy users demand advanced features to manage finances effectively. Let’s explore some of these advanced features.

Investment Tracking

Advanced home budget software includes investment tracking. This helps you monitor your portfolio easily. You can track stocks, bonds, and mutual funds. The software updates values in real-time. This ensures you always know your portfolio’s worth.

Investment tracking also provides detailed reports. These show gains, losses, and overall performance. You can make informed decisions based on accurate data. Some software even offers predictive analysis. This helps forecast future trends.

Tax Preparation Assistance

Preparing taxes can be stressful. Advanced budget software can help. It offers tax preparation assistance. This feature organizes your financial data for tax season. You can categorize expenses and income easily.

The software generates tax reports. These reports are ready for filing. Some programs integrate with tax filing services. This makes the process seamless. You can avoid errors and save time. The software also keeps track of tax deductions. You can maximize your refund with ease.

| Feature | Benefit |

|---|---|

| Investment Tracking | Real-time updates, detailed reports, predictive analysis |

| Tax Preparation Assistance | Organized data, ready-to-file reports, integration with tax services |

These advanced features make home budget software indispensable. They cater to the needs of savvy users. Managing your finances has never been easier.

Making The Final Decision

Choosing the best home budget software for PC can be tough. There are many options, each with unique features. To help, consider the following aspects.

Cost Vs. Benefit

Analyze the cost and benefit of each software. Paid software often provides more features. Free versions might be limited. Look for software that gives the most value for your money.

| Software | Cost | Benefits |

|---|---|---|

| Software A | $50/year | Advanced tracking, multiple users, customer support |

| Software B | Free | Basic tracking, single user, community support |

Trial Periods And Money-back Guarantees

Many software providers offer trial periods. This lets you test before buying. Check if there’s a money-back guarantee. This ensures you can get a refund if you’re not satisfied.

- Software A: 30-day free trial, 60-day money-back guarantee

- Software B: 14-day free trial, no money-back guarantee

Consider these factors to make an informed decision. This helps you choose the best budget software for your needs.

Setting Up Your Budget

Getting started with a home budget software can be simple and rewarding. Follow these steps to set up your budget effectively.

Initial Setup Guide

First, download and install the budget software on your PC. Open the software and create a new account using your email. Follow the on-screen prompts to enter your basic information.

Next, connect your bank accounts and credit cards. This allows the software to track your expenses automatically. You can do this by selecting ‘Add Account’ and entering your bank login details.

After connecting your accounts, categorize your expenses. The software may suggest categories like groceries, utilities, and entertainment. You can use these or create your own.

Customizing To Your Needs

Once the initial setup is complete, you can customize the software to fit your needs. Set budget limits for each category. For example, you might set $200 for groceries and $100 for entertainment.

Create budget goals to help you save money. This could include saving for a vacation or paying off debt. Use the goal-setting feature to track your progress.

Customize notifications to stay on track. Set alerts for when you are close to your budget limits. This helps you avoid overspending.

| Category | Monthly Limit |

|---|---|

| Groceries | $200 |

| Utilities | $150 |

| Entertainment | $100 |

Adjust these limits as needed based on your spending habits. Regularly review your budget and make changes to improve your financial health.

- Download and install the software

- Connect your bank accounts

- Categorize your expenses

- Set budget limits for each category

- Create goals for saving money

- Customize notifications for budget alerts

Maintaining And Adjusting Your Budget

Maintaining your budget is crucial for financial success. Adjusting it ensures you stay on track. Using home budget software can make these tasks easier. This section covers the importance of regular check-ins and adapting to financial changes.

Regular Check-ins

Regular check-ins help you track your spending. Set a weekly schedule to review your budget. Use your software to compare your spending with your budget. Are you spending more on groceries than planned? Adjust your habits or budget as needed.

Many home budget software options offer alerts. These alerts notify you of overspending. Set these alerts to stay within your limits. This keeps you aware of your financial health. Staying on top of your budget helps you avoid financial stress.

Adapting To Financial Changes

Life changes can impact your budget. Losing a job or getting a raise affects your finances. Your budget should reflect these changes. Use your software to update your income and expenses. This ensures your budget is always accurate.

Unexpected expenses can arise. Medical bills or car repairs can disrupt your budget. Plan for these by having an emergency fund. Update your budget to include savings for unexpected costs. This prepares you for financial surprises.

| Scenario | Action |

|---|---|

| Job Loss | Reduce discretionary spending |

| Raise or Promotion | Increase savings and investments |

| Unexpected Medical Bill | Use emergency fund |

Using home budget software makes managing your finances easier. Regular check-ins and adapting to changes keep your budget relevant. This helps you achieve your financial goals.

Conclusion: Taking Control Of Your Finances

Managing your finances can be stressful. The right home budget software for PC offers a solution. This software empowers you to track and control your spending. It helps you plan for future expenses and save money. In this conclusion, we explore how budgeting software can empower you and improve your long-term financial health.

Empowerment Through Budgeting

Home budget software makes budgeting easier. It provides tools to categorize your expenses. You can see where your money goes every month. This visibility helps you make informed decisions. You can cut unnecessary expenses and save more. The software also allows you to set financial goals. Achieving these goals gives you a sense of accomplishment and control.

Long-term Financial Health

Using budget software ensures long-term financial stability. It helps you plan for big expenses like vacations or emergencies. You can create a savings plan and stick to it. This planning reduces financial stress. Over time, you build a strong financial foundation. You also develop good money habits. These habits contribute to your overall financial health.

Here is a quick comparison of some popular home budget software:

| Software | Features | Price |

|---|---|---|

| YNAB (You Need A Budget) | Goal tracking, debt payoff, real-time sync | $11.99/month |

| Mint | Bill tracking, free credit score, investment tracking | Free |

| Quicken | Investment tracking, bill pay, custom reports | $34.99/year |

- Budgeting: Track and categorize expenses.

- Savings Goals: Set and achieve financial goals.

- Financial Planning: Plan for big expenses and emergencies.

- Choose the software that fits your needs.

- Set up your budget categories.

- Track your spending regularly.

Frequently Asked Questions

What Is The Best Software To Create A Budget?

The best software to create a budget is You Need a Budget (YNAB). It offers powerful features and user-friendly design.

What Is The Best Software To Keep Track Of Personal Expenses?

The best software to track personal expenses is Mint. It offers budgeting tools, expense tracking, and financial insights.

What Is The Best Free Program To Track Personal Finances?

Mint is the best free program to track personal finances. It offers budgeting tools, expense tracking, and financial goal setting. Its user-friendly interface makes managing money simple.

What Is Better Than Mint?

YNAB (You Need A Budget) is often considered better than Mint. It offers proactive budgeting, detailed tracking, and educational resources. Users find YNAB’s approach helps them save more money and reduce debt effectively.

Conclusion

Choosing the right home budget software can transform your financial management. The best options offer user-friendly interfaces and robust features. With effective budgeting tools, you can track expenses, set goals, and save money. Make a smart choice today and take control of your finances effortlessly.

Happy budgeting!