TurboTax and UFile are the best Canadian tax software options for Mac users. They offer user-friendly interfaces and robust features.

Filing taxes can be daunting, but the right software simplifies the process. TurboTax and UFile stand out for Mac users in Canada due to their comprehensive features and ease of use. TurboTax provides step-by-step guidance, ensuring accuracy and maximizing refunds.

UFile, on the other hand, offers a simple interface with extensive support options. Both platforms are designed to handle Canadian tax regulations efficiently. They also support various income sources and deductions, making them suitable for diverse financial situations. Choosing the right tax software can save time and reduce stress, ensuring a smooth tax season.

Introduction To Canadian Tax Software For Mac

Filing taxes can be daunting. For Mac users, it’s important to find the right software. Canadian tax software for Mac makes the process easier. It offers features tailored for Mac systems. This ensures a smooth and efficient tax filing experience.

Why Choose Mac-specific Tax Software?

Mac-specific tax software is designed for Mac operating systems. It ensures compatibility and seamless integration. This software uses Mac’s unique features to enhance user experience.

Here are some reasons to choose Mac-specific tax software:

- Optimized for Mac’s interface and design.

- Fewer bugs and crashes compared to generic software.

- Better customer support for Mac users.

Benefits Of Using Tax Software

Using tax software offers many benefits. It simplifies complex tax calculations. It also helps to avoid mistakes.

Some of the key benefits include:

- Accuracy: Software reduces the chances of errors.

- Speed: Complete your tax return faster.

- Convenience: File taxes from the comfort of your home.

- Cost-effective: Many software options are affordable or free.

- Guidance: Step-by-step instructions make the process easy.

| Feature | Benefit |

|---|---|

| Automated Calculations | Reduces human error |

| e-Filing | Speeds up processing time |

| Data Import | Saves time on manual entry |

Key Features To Look For In Tax Software

Choosing the best Canadian tax software for Mac can simplify your tax season. There are several key features to consider. This guide will help you find the right software for your needs.

Ease Of Use

The tax software should have an intuitive interface. It should guide you through each step. Simple instructions can make a big difference. Look for software with clear, easy-to-follow prompts.

Many users appreciate a step-by-step wizard. This feature helps you enter your information correctly. It reduces the chance of mistakes. The software should also be compatible with Mac OS.

Accuracy And Security

Accuracy is crucial for tax software. The software should automatically check for errors and omissions. This feature ensures your tax return is accurate.

Security is another key feature. Your personal information should be protected. Look for software with encryption and secure servers. This keeps your data safe from hackers.

| Feature | Description |

|---|---|

| Ease of Use | Intuitive interface, clear prompts, Mac OS compatible |

| Accuracy | Automatic error checking |

| Security | Encryption, secure servers |

These features can make filing taxes easier. Choose software with these features for a smooth experience.

Top Picks For Canadian Tax Software For Mac

Finding the best tax software for your Mac can be challenging. Many options are available, but not all are suited for Canadian users. This guide highlights the top picks for Canadian tax software tailored for Mac users. Whether you need a comprehensive tool or a budget-friendly option, we’ve got you covered.

Software A: A Comprehensive Tool

Software A offers a thorough solution for tax filing. It is ideal for users who need detailed features. Here are some key aspects of Software A:

- User-Friendly Interface: The interface is easy to navigate.

- Advanced Features: Includes tools for investment income and rental property.

- Security: High-level encryption ensures your data is safe.

The software also supports multiple tax returns, making it ideal for families. It provides a step-by-step guide through each section. This makes the process simple and quick.

Software B: Budget-friendly Option

Software B is perfect for those on a budget. Despite its lower cost, it does not compromise on quality. Here are some highlights of Software B:

- Affordable Price: Costs less than many competitors.

- Basic Features: Covers essential tax filing needs.

- Compatibility: Works seamlessly on Mac devices.

This software is suitable for individuals with straightforward tax situations. It guides users through the filing process with ease. The lower price point makes it accessible for everyone.

| Feature | Software A | Software B |

|---|---|---|

| Price | Higher | Lower |

| Advanced Features | Yes | No |

| User-Friendly | Yes | Yes |

| Security | High | Moderate |

Each software option has its benefits. Whether you need a comprehensive tool or a budget-friendly option, you can find the right fit for your needs.

Comparing Prices And Plans

Comparing prices and plans helps you choose the best tax software for Mac. This guide covers the differences between free and paid versions. It also looks at the value of different plans. Let’s dive into the details.

Free Vs. Paid Versions

Free versions of tax software offer basic features. They are ideal for simple tax returns. Paid versions come with advanced features and support. These are great for complex tax situations.

Here’s a quick comparison:

| Feature | Free Version | Paid Version |

|---|---|---|

| Basic Tax Filing | Yes | Yes |

| Customer Support | Limited | 24/7 |

| Complex Tax Situations | No | Yes |

| Audit Assistance | No | Yes |

Plan Comparisons And Value

Paid plans offer various features. Let’s compare some popular plans:

| Plan | Cost | Main Features |

|---|---|---|

| Basic | $20 |

|

| Standard | $40 |

|

| Premium | $60 |

|

Each plan offers value depending on your needs. Choose the one that fits your tax situation. Remember, investing in a paid plan can save time and stress.

User Reviews And Testimonials

Choosing the best Canadian tax software for Mac can be overwhelming. User reviews and testimonials provide real-world insights. They highlight strengths and weaknesses, helping you make an informed decision.

Success Stories

Many users praise the ease of use. They appreciate the intuitive interface and straightforward navigation.

- One user shared, “I filed my taxes in under an hour!”

- Another noted, “I got a bigger refund than expected.”

- Many users highlight excellent customer support.

These success stories demonstrate the software’s efficiency.

Common Criticisms

Not all feedback is positive. Some users report challenges. Common criticisms include:

| Issue | Details |

|---|---|

| Software Bugs | Occasional crashes reported during peak times. |

| High Cost | Some users find the software expensive. |

| Complex Features | Advanced features can confuse beginners. |

Understanding these criticisms helps set realistic expectations.

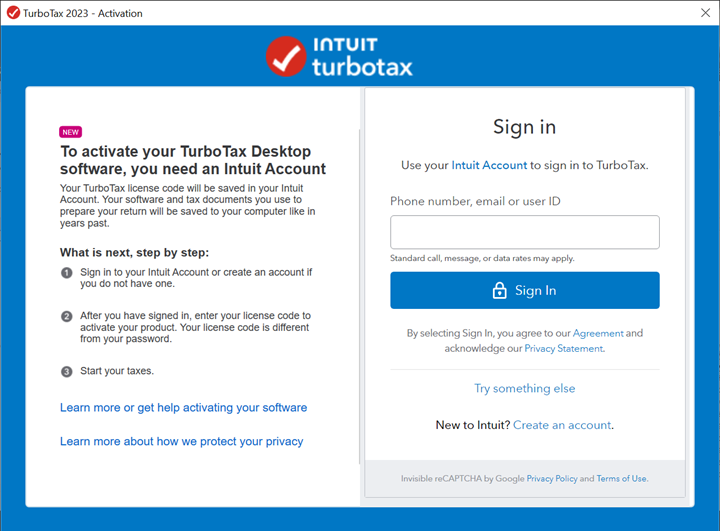

Installation And Setup Guide

Installing and setting up tax software on your Mac can be easy. With this guide, you will quickly get the best Canadian tax software running. Follow the instructions below for a smooth installation and setup.

Step-by-step Installation

Follow these simple steps to install the tax software on your Mac:

- Download the Software: Visit the official website and download the installer.

- Open the Installer: Locate the downloaded file and double-click to open it.

- Drag to Applications: Drag the software icon into the Applications folder.

- Launch the Software: Go to the Applications folder and open the software.

Initial Setup And Configuration

Once installed, follow these steps for initial setup:

- Accept Terms: Read and accept the terms and conditions.

- Create an Account: Enter your email and create a password.

- Verify Email: Check your email for a verification link.

- Personalize Settings: Set your preferences and profile details.

Now, you are ready to use the tax software on your Mac. Follow the guide for a quick and easy setup.

Navigating The Interface

The best Canadian tax software for Mac ensures ease of use. Navigating the interface should feel intuitive and smooth. Let’s break it down for you.

Dashboard Overview

The dashboard is the first screen you see. It offers a clear view of your tax journey. The dashboard includes:

- Current status of your tax return

- Sections to complete

- Quick links to common tasks

The layout is clean and simple. Important information is highlighted for easy access. Notifications guide you through each step. The progress tracker helps you stay on top of your work.

Entering Your Tax Information

Inputting your tax details should be straightforward. The software offers a guided process. Each section is clearly labeled and easy to understand.

- Income: Enter your salary, freelance earnings, and other income.

- Deductions: Include eligible expenses and deductions.

- Credits: Input any tax credits you qualify for.

Use the help icons for extra guidance. The system checks for errors as you go. It ensures you don’t miss any important details.

The interface also supports importing data. You can upload forms like T4s directly. This feature saves time and reduces manual entry errors. The software simplifies complex tax rules, making it user-friendly. Always keep your documents handy for reference.

Troubleshooting Common Issues

Using tax software on a Mac can sometimes present challenges. Common issues include software updates, technical glitches, and needing support. This guide addresses these problems and offers solutions.

Software Updates And Fixes

Software updates are crucial for smooth functioning. Ensure your tax software is up-to-date. Regular updates fix bugs and enhance features.

To update your software:

- Open the tax software application.

- Navigate to the settings or help menu.

- Select ‘Check for updates’.

- Follow the on-screen instructions to install updates.

If updates fail, check your internet connection. Restart your Mac and try again.

Getting Support And Help

If you face issues, getting support is essential. Most tax software providers offer various support options.

Here are ways to get help:

- Visit the official support website.

- Use the built-in help feature within the software.

- Contact customer service via phone or email.

- Join user forums or communities.

For quick fixes, the FAQ section on the software’s website is helpful.

If you need personal assistance, consider using live chat or scheduling a call.

Maximizing Tax Returns With Software Features

Using the best Canadian tax software for Mac can significantly boost your tax returns. These tools offer numerous features designed to optimize your filings. With the right software, you can easily claim all eligible deductions and credits. This section will guide you through the key features you should look for.

Deductions And Credits

Tax software often includes a comprehensive list of deductions and credits. These features ensure you don’t miss out on any benefits.

- Automated calculations for common deductions.

- Step-by-step guides for claiming credits.

- Real-time updates on new tax laws.

Some software even offers a deduction finder tool. This tool scans your financial data to find eligible deductions. It helps you get the most out of your tax return.

Optimizing Your Filing

Optimizing your tax filing is crucial for maximizing returns. The best tax software for Mac includes features that streamline this process.

- Error-checking tools to avoid mistakes.

- Import options for previous years’ data.

- E-filing capabilities for quick submissions.

These features save you time and reduce stress. They also ensure you file your taxes accurately and efficiently.

Looking Ahead: Future Of Tax Software On Mac

The future of tax software on Mac looks promising. Rapid advancements in technology are shaping new possibilities. Users can expect more efficient and user-friendly experiences.

Technological Advancements

Technology is evolving at a rapid pace. Artificial Intelligence (AI) and Machine Learning (ML) are transforming tax software. These technologies help in automating complex calculations. They also minimize human errors. Cloud computing offers seamless data access and storage.

Security features are also improving. Encryption techniques ensure data safety. Biometric authentication adds an extra layer of security. Users can complete their tax filings with peace of mind.

Predictions And Trends

Here are some predictions and trends for tax software on Mac:

- Increased Automation: More tasks will be automated. This will save users time and effort.

- Enhanced User Experience: Interfaces will become more intuitive. Users will find the software easier to navigate.

- Integration with Other Tools: Tax software will integrate with accounting and financial tools. This will provide a seamless experience.

- Real-Time Updates: Tax software will provide real-time updates. Users will stay informed about the latest tax laws.

- Mobile Compatibility: Mobile versions of tax software will become more common. Users can file taxes from their phones.

| Trend | Expected Impact |

|---|---|

| Increased Automation | Reduced manual effort, quicker filings |

| Enhanced User Experience | Better navigation, user satisfaction |

| Integration with Other Tools | Seamless experience, data consistency |

| Real-Time Updates | Stay informed, accurate filings |

| Mobile Compatibility | File taxes on the go, convenience |

These advancements and trends indicate a bright future. Tax software on Mac will continue to evolve and improve.

Frequently Asked Questions

What Is The Most Popular Tax Software In Canada?

TurboTax is the most popular tax software in Canada. It offers user-friendly features and reliable customer support.

Is There A Canadian Version Of Turbotax?

Yes, TurboTax has a Canadian version. It helps Canadians file their taxes online easily and accurately.

Is H&r Block Better Than Turbotax Canada?

H&R Block and TurboTax Canada both offer robust tax services. H&R Block provides in-person support, while TurboTax excels online. Choose based on your preference for personal assistance or digital convenience.

Is Turbotax Good For Mac?

Yes, TurboTax works well on Mac. It offers a user-friendly interface and robust features for tax filing. TurboTax supports macOS seamlessly.

Conclusion

Choosing the best Canadian tax software for Mac simplifies tax season. Each software offers unique features to suit different needs. Evaluate your requirements and select the one that fits best. Save time and stress by using reliable tax software. Enjoy peace of mind knowing your taxes are handled efficiently.