The best budgeting software for Mac is YNAB (You Need A Budget) and Quicken. Both offer powerful tools for managing finances.

Budgeting software helps streamline financial planning. Mac users need intuitive, efficient, and reliable solutions. YNAB stands out for its proactive budgeting approach, helping users allocate every dollar purposefully. Quicken, on the other hand, offers comprehensive features for tracking expenses, investments, and bills.

Both options provide robust support and seamless integration with Mac systems. Choosing the right software depends on personal preferences and specific financial needs. Whether prioritizing simplicity or advanced features, YNAB and Quicken are top choices for effective budget management on a Mac.

Introduction To Budgeting On Mac

Managing your finances is essential. Budgeting software helps you track spending and save money. Mac users have unique needs. So, specialized budgeting software can make life easier. Let’s explore why this is important and the benefits it offers.

Why Mac Users Need Specialized Software

Mac computers have a unique operating system. Specialized software ensures compatibility and a smooth experience. Here are a few reasons:

- Seamless Integration: Works well with macOS features.

- User Interface: Designed for Mac’s aesthetic and usability.

- Security: Leveraging Mac’s robust security features.

Benefits Of Using Budgeting Software

Using budgeting software on a Mac offers numerous benefits:

- Automated Tracking: Automatically records transactions.

- Expense Categorization: Helps organize your spending.

- Financial Insights: Provides reports and analytics.

- Goal Setting: Assists in setting and tracking financial goals.

- Synchronization: Syncs across devices for easy access.

| Feature | Benefit |

|---|---|

| Automated Tracking | Saves time and reduces errors |

| Expense Categorization | Organizes spending for better analysis |

| Financial Insights | Helps make informed decisions |

| Goal Setting | Keeps you focused on financial objectives |

| Synchronization | Access data across multiple devices |

Criteria For Selecting Budgeting Software

Choosing the best budgeting software for Mac can be challenging. There are several factors to consider. The right software will help manage finances effortlessly. Here are some key criteria for selecting budgeting software.

Ease Of Use

User-friendly interfaces are crucial for budgeting tools. You want software that is easy to navigate. Simple menus and clear instructions make a big difference. Look for drag-and-drop features and intuitive design.

Setup process should be straightforward. The software should guide you step-by-step. Quick setup means you start budgeting sooner. Avoid software that requires extensive tutorials.

Customer support availability is important. Choose software with 24/7 support. This ensures help is available when needed. FAQs and chat support are also valuable.

Integration With Mac Ecosystem

Compatibility with macOS is non-negotiable. The software must work seamlessly on a Mac. Check for regular updates that align with macOS updates.

Synchronization with other Apple apps is beneficial. Look for software that integrates with iCloud. This enables data access across all Apple devices.

Security features should be robust. The software must protect your financial data. Look for encryption and two-factor authentication.

Cost Efficiency

Budget-friendly pricing is essential. Many options offer free trials. Compare prices and features before committing. Some software offers one-time purchases. Others may require a subscription.

Value for money should be considered. More expensive software might offer advanced features. Free versions can be limited but sufficient for basic needs.

Hidden costs should be avoided. Ensure there are no extra fees. Read the fine print before purchasing.

| Criteria | Features |

|---|---|

| Ease of Use | User-friendly, Simple setup, 24/7 support |

| Integration | macOS compatibility, iCloud sync, Robust security |

| Cost Efficiency | Budget-friendly, Value for money, No hidden costs |

Top Affordable Picks For Mac Users

Managing finances can be tough, especially on a budget. Luckily, there are several affordable budgeting software options available for Mac users. These tools help track expenses, create budgets, and plan for the future. Here are some top affordable picks that won’t break the bank.

Quicken For Mac

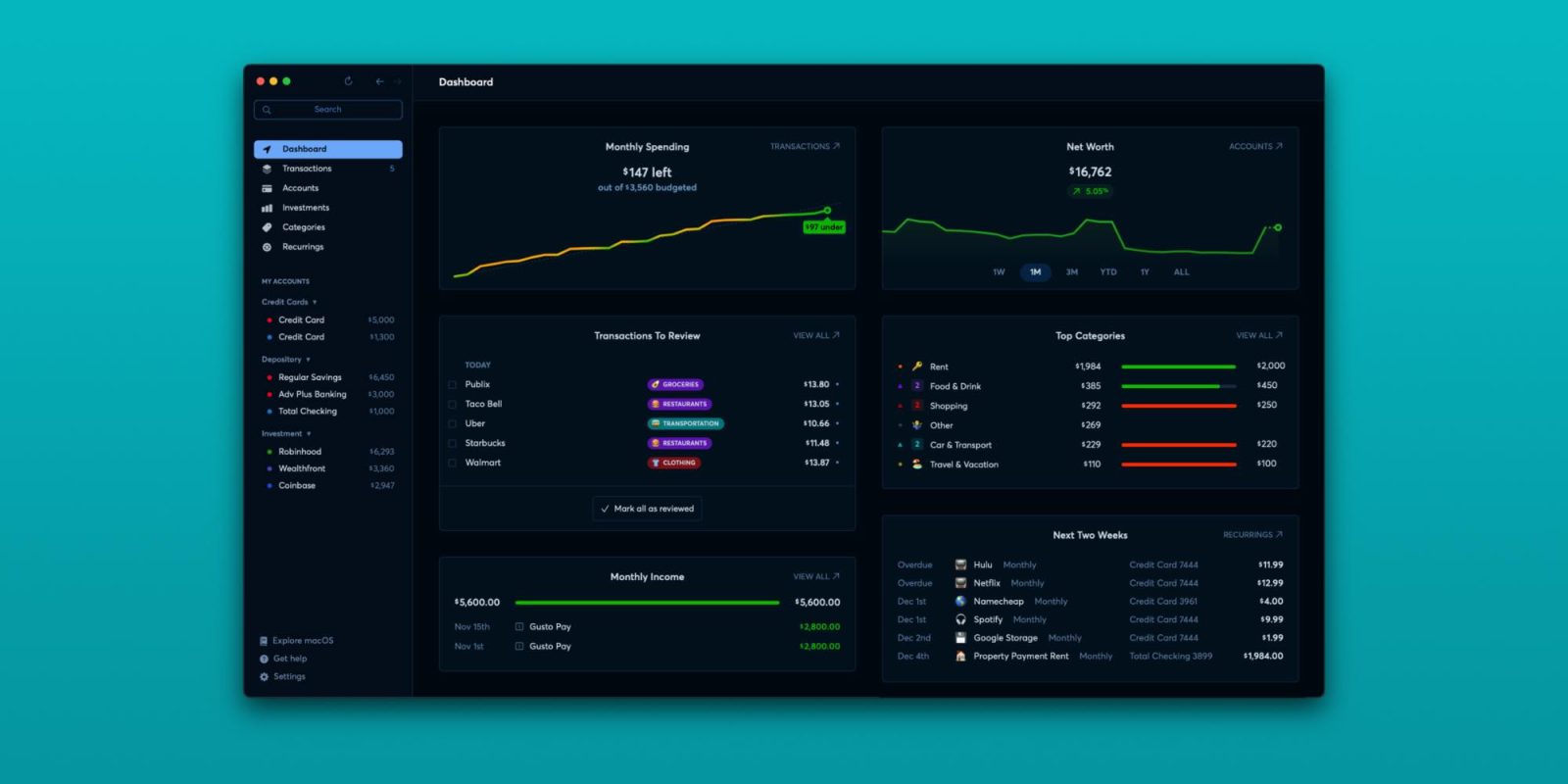

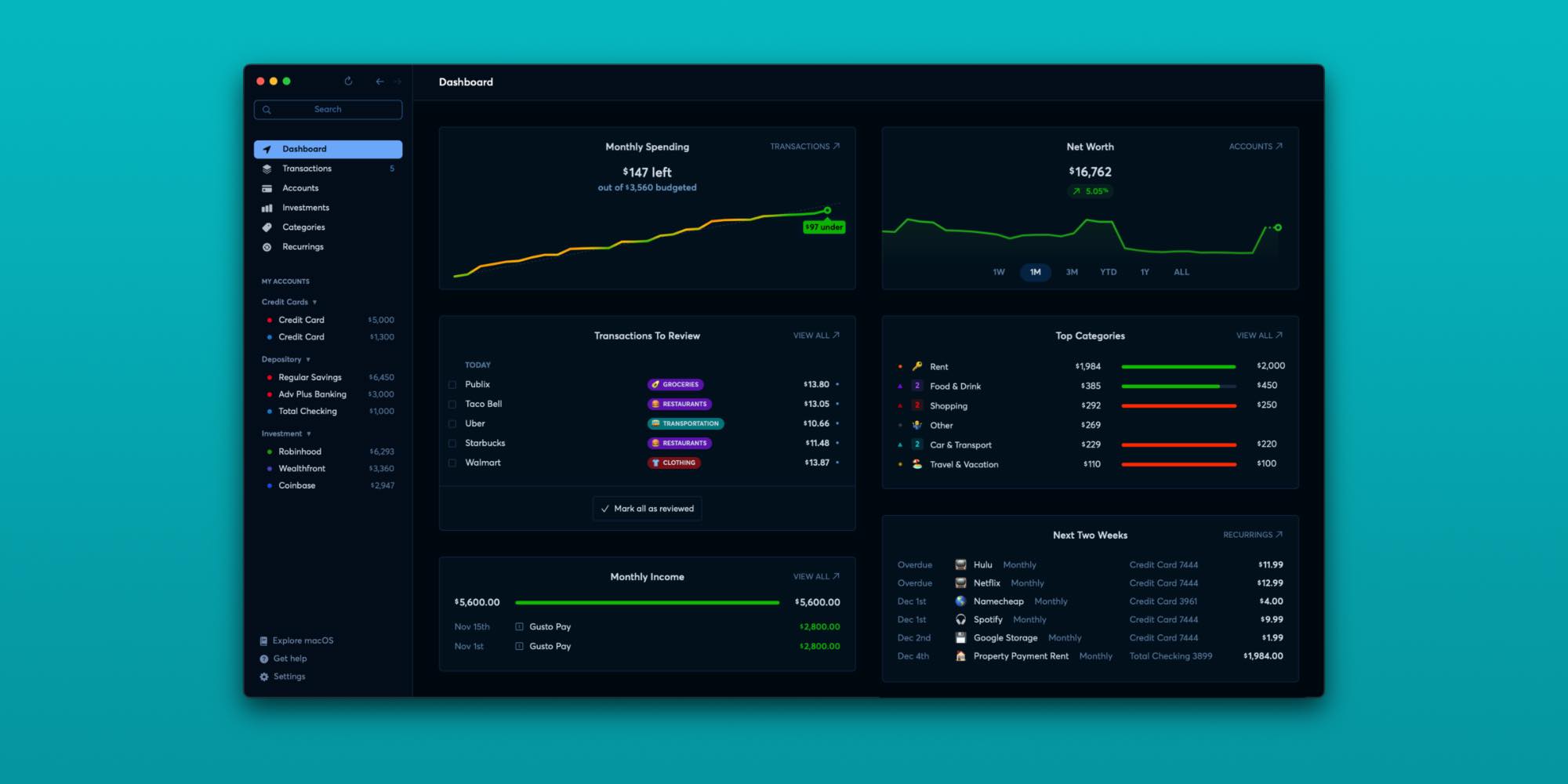

Quicken for Mac is a powerful tool for managing your finances. It offers a variety of features to help you stay on top of your budget. Users can track spending, create budgets, and plan for financial goals.

- Track income and expenses

- Create custom budgets

- Monitor investments

- Generate financial reports

Quicken offers a user-friendly interface that makes managing finances easy. Its comprehensive features make it a top choice for many Mac users.

Mint: A Free Alternative

Mint is a free budgeting tool that offers a wide range of features. It is a great option for those who want to manage finances without spending money.

- Track expenses and income

- Create budgets and financial goals

- Receive bill reminders

- Access credit score monitoring

Mint’s user-friendly dashboard helps users see their financial health at a glance. Its free cost makes it accessible to everyone.

Ynab (you Need A Budget)

YNAB is another excellent budgeting tool for Mac users. It focuses on helping users allocate every dollar they earn. This approach helps users stay in control of their finances.

- Allocate income to specific categories

- Track spending and savings

- Plan for future expenses

- Sync across devices

YNAB’s method of budgeting helps users build better financial habits. Its powerful features and ease of use make it a popular choice.

Key Features To Look For

Choosing the best budgeting software for Mac can be challenging. To simplify this, focus on key features. These features help manage your finances effectively. Below are essential features to consider.

Automatic Transaction Import

An important feature is Automatic Transaction Import. This saves time and ensures accuracy. The software should sync with your bank accounts. This allows automatic updates of your transactions. It helps keep track of your spending. This feature also reduces manual data entry.

Investment Tracking

Investment Tracking is crucial for monitoring your assets. The software should track stocks, bonds, and other investments. It should provide real-time updates. This helps you understand your investment performance. Having this feature helps in making informed decisions.

Debt Payoff Planning

Debt Payoff Planning helps manage and reduce debts. The software should offer tools for creating payoff plans. It should track your progress. This feature helps in setting realistic goals. It also keeps you motivated to pay off debts faster.

Comparing The Best Budgeting Tools

Finding the right budgeting software for Mac can be tough. We have compared the top tools to help you decide. This section covers user interface, features, and pricing.

User Interface Comparison

The user interface is crucial for budgeting software. A clean and intuitive interface makes a tool easier to use.

- YNAB: YNAB has a sleek and modern design. It uses a simple layout that helps users focus.

- Mint: Mint offers a colorful and engaging interface. It includes graphs and charts for better visualization.

- Moneydance: Moneydance provides a classic look. Its interface might seem outdated but is functional.

Feature Set And Limitations

Each tool comes with different features and limitations. Below is a comparison to help you understand what each offers.

| Tool | Key Features | Limitations |

|---|---|---|

| YNAB |

|

|

| Mint |

|

|

| Moneydance |

|

|

Pricing And Value

Pricing is a critical factor when choosing budgeting software. Here’s a breakdown of the costs and value each tool offers:

- YNAB: $11.99 per month or $84 annually. It offers a 34-day free trial.

- Mint: Free with ads. There’s a premium version for $4.99 per month.

- Moneydance: One-time fee of $49.99. Free trial is available.

Consider your budget and needs before making a choice.

Setting Up Your Budgeting Software

Setting up your budgeting software is key to managing your finances efficiently. The right setup ensures you track expenses, save money, and achieve financial goals. In this section, we’ll guide you through the steps to set up your budgeting software on a Mac, making it easier to manage your budget.

Initial Setup Tips

- Download and Install: Start by downloading the software from the official website. Follow the prompts to install it on your Mac.

- Create an Account: Sign up using your email address. This helps you sync data across devices.

- Connect Your Bank Accounts: Link your bank accounts for automatic transaction tracking.

- Set Up Security: Enable two-factor authentication to protect your financial data.

Customizing Categories

Customizing categories helps you better organize your expenses. Follow these steps to set up categories:

- Default Categories: Check the default categories provided by the software.

- Add New Categories: Create new categories that fit your spending habits.

- Rename Categories: Rename existing categories for clarity.

- Delete Unused Categories: Remove categories you don’t need to keep your budget clean.

Setting Financial Goals

Setting financial goals is crucial for achieving financial stability. Use your budgeting software to set and track goals:

| Goal | Description | Timeline |

|---|---|---|

| Emergency Fund | Save for unexpected expenses | 6 months |

| Debt Repayment | Pay off credit card debt | 12 months |

| Vacation Fund | Save for a family vacation | 1 year |

Track Progress: Regularly check your progress towards each goal.

Adjust Goals: Modify goals if your financial situation changes.

Maximizing Your Budgeting Software

Budgeting software for Mac can help you manage your finances. To get the most out of it, you need to maximize its features. This section will guide you on how to do that effectively.

Regular Review And Adjustment

Regularly reviewing your budget is crucial. This helps you stay on track. Make it a habit to check your budget weekly. Adjust your categories based on your spending. If you overspend, you can see where to cut back.

Use the software’s reporting tools. These tools can show you trends in your spending. Adjust your budget as needed. This keeps your finances in check.

Integrating With Other Financial Tools

Integration with other financial tools can be a game-changer. Link your budgeting software with your bank accounts. This helps you track your spending in real-time. Many budgeting tools support integration with investment accounts. This gives you a full picture of your financial health.

Consider integrating with tax software. This can simplify tax season. Make sure your software supports these integrations.

Leveraging Community Resources

Many budgeting tools have active communities. These communities can offer tips and advice. Join forums and groups related to your software. You can learn new strategies to improve your budgeting.

Community resources can also offer troubleshooting help. If you face issues, other users might have solutions. This makes it easier to use your software effectively.

Alternatives And Supplementary Tools

Finding the best budgeting software for Mac can be challenging. Many users prefer exploring alternatives and supplementary tools to enhance their financial management experience. These tools can be mobile apps, web-based options, or investment tracking tools. Let’s dive into some of the best choices.

Mobile Apps For On-the-go Budgeting

Mobile apps are great for managing your budget anywhere. These apps sync with your Mac and keep your budget updated in real-time.

- YNAB (You Need A Budget): This app offers budgeting and financial planning features. It helps you track expenses and savings goals.

- Mint: Mint connects to your bank accounts and tracks your spending. It also provides alerts for bill payments and low balances.

- Goodbudget: Goodbudget uses the envelope method for budgeting. It helps you allocate your money into different spending categories.

Web-based Options For Mac Users

Web-based budgeting tools are accessible from any device with an internet connection. These tools often offer more features than mobile apps.

| Tool | Features |

|---|---|

| Personal Capital | Investment tracking, budgeting, and retirement planning. |

| EveryDollar | Zero-based budgeting, debt tracking, and goal setting. |

| CountAbout | Import data from Quicken and Mint, customizable categories. |

Supplementary Tools For Investment Tracking

Investment tracking tools help you monitor your portfolio. They can provide insights and analytics to optimize your investments.

- Robinhood: This app offers commission-free trading and investment tracking.

- Acorns: Acorns invest your spare change automatically. It helps you build a diversified portfolio.

- Stock Rover: Stock Rover provides detailed analytics for your investments. It also offers portfolio management features.

Using these alternatives and supplementary tools can enhance your budgeting experience. They offer diverse features that cater to different financial needs.

Frequently Asked Questions

What Is The Best Budget Program For Mac?

The best budget program for Mac is “Moneydance. ” It offers robust features, ease of use, and affordability.

Is There A Mint App For Mac?

No, Mint does not have a dedicated app for Mac. Use Mint’s web version on your Mac browser.

What Is The Best Software To Keep Track Of Personal Expenses?

The best software to track personal expenses is Mint. It offers budgeting tools, expense tracking, and financial goal setting.

What Is The Easiest Budgeting App To Use?

The easiest budgeting app to use is Mint. It offers user-friendly features, automatic expense tracking, and simple budget creation.

Conclusion

Choosing the right budgeting software for your Mac can simplify your financial management. The tools mentioned offer various features to suit your needs. Start exploring these options to find the perfect fit for your budget. Effective budgeting leads to better financial health and peace of mind.

Make the smart choice today!